41 duration zero coupon bond

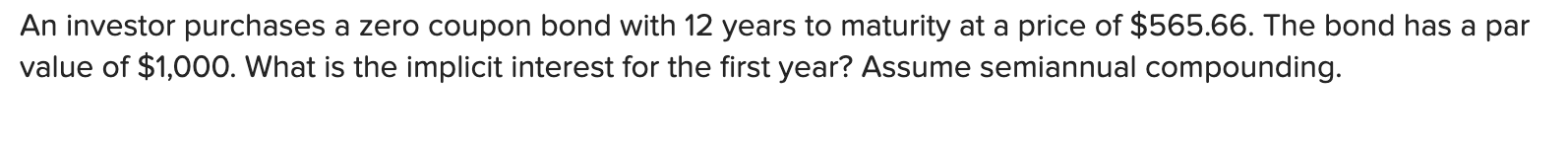

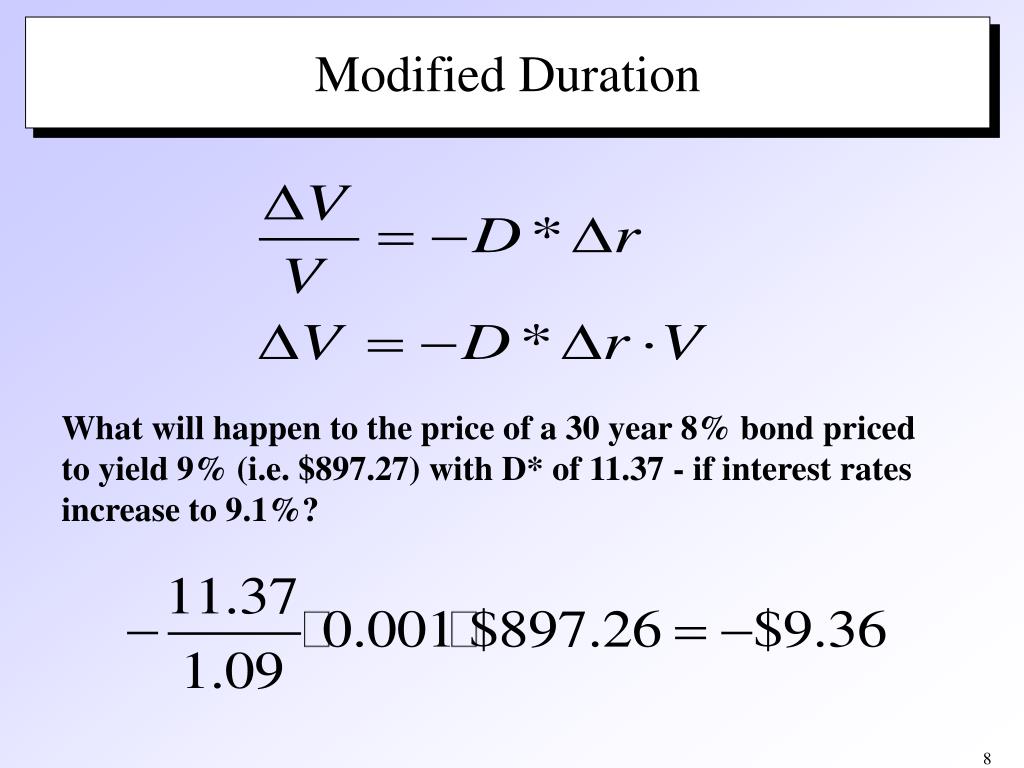

What Is Interest Rate Risk? Why Is It Important? - BFIA This bond has a higher yield, 4.5%, but it also has a higher duration, at 14.5 years. So if rates rose 2% in this situation, the bond would actually lose 26% of its value! Even though the 30-Year bond has a higher yield, its higher duration makes it more susceptible to interest rate fluctuations. What Is the Interest Rate Risk Premium? How to Invest in Bonds: A Beginner's Guide to Buying Bonds For example, you might buy a 10-year, $10,000 bond paying 3% interest. Your town, in exchange, will promise to pay you interest on that $10,000 every six months, and then return your $10,000 after...

EDV Vanguard Extended Duration Treasury ETF - Seeking Alpha Vanguard World Fund - Vanguard Extended Duration Treasury ETF is an exchange traded fund launched and managed by The Vanguard Group, Inc. The fund invests in the fixed income markets of the United...

Duration zero coupon bond

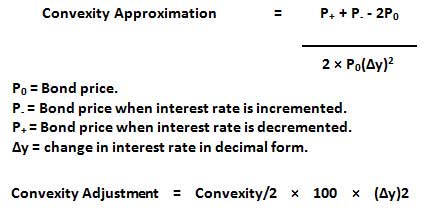

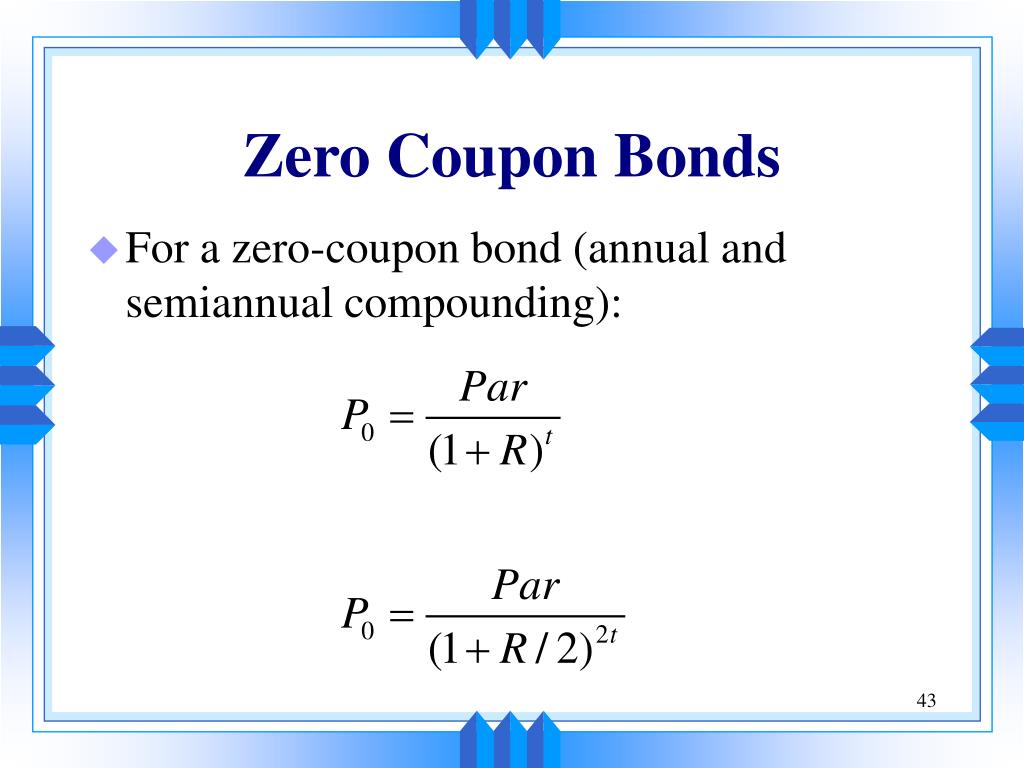

Tax Free Bond - REC Limited Foreign Currency Bonds. Post-issuance certification from Climate Bond Initiative, London; REC Green Bond Framework; Certificate from Climate Bond Initiative, London; Annual Update Report for Green Bonds as on March 31, 2021; Tax Free Bond; Infrastructure Bonds; Taxable Bond; Forms for Bonds; Market Linked Debentures Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.17 pages Abhishek Kothari 🇮🇳 on Twitter: "Muthoot Finance plans to raise at ... "Muthoot Finance plans to raise at least Rs75 cr via public issue of bonds Andhra Pradesh State Beverages Corp may raise funds via longer duration bonds next month CPs EXIM Bank to raise funds via three-month CP at 5.10% coupon Tata Power to raise funds via three-month CP at"

Duration zero coupon bond. EDV | ETF Snapshot - Fidelity The advisor employs an indexing investment approach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index. This index includes zero-coupon U.S. Treasury securities (Treasury STRIPS), which are backed by the full faith and credit of the U.S. government, with maturities ranging from 20 to 30 years. PIMCO 25+ Year Zero Coupon US Treasury Index ETF Bond Duration Long-Term FactSet Classifications Trading Data Open Volume Day Lo Day Hi 52 Week Lo $104.91 52 Week Hi $162.24 AUM $386.9 M Shares 3.5 M Historical Trading Data 1 Month Avg. Volume 177,752 3 Month Avg. Volume 195,290 Alternative ETFs in the ETF Database Government Bonds Category Domestic bonds: Nigeria, Bills 0% 25may2023, NGN (364D) 05-25-2022 364DAY Domestic bonds: Nigeria, Bills 0% 25may2023, NGN (364D) 05-25-2022 364DAY Download Copy to clipboard Add to WL Zero-coupon bonds, Bills Status Outstanding Amount 168,666,291,000 NGN Placement *** Early redemption *** (-) ACI on *** Country of risk Nigeria Current coupon *** % Price *** % Yield / Duration - Calculator What is a calculator? Long Term Government Bond ETF List - ETFdb.com Long Term Government Bond ETF List. Long Term Government Bond ETFs provide investors with exposure to the long side of the U.S. bond market. These funds focus on debt sponsored by the U.S. government or its agencies and can include Treasuries, MBS, TIPS or other debt. Long-term bonds generally have maturities longer than 10 years.

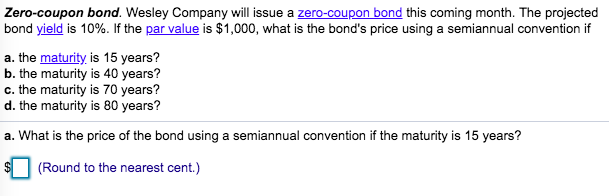

iShares 0-5 Year Investment Grade Corporate Bond ETF 1. Exposure to short-term U.S. investment grade corporate bonds. 2. A complement for investment grade corporate bond ETFs, like LQD. 3. Use to express a view on corporate bond interest rate risk. INVESTMENT OBJECTIVE. The iShares 0-5 Year Investment Grade Corporate Bond ETF seeks to track the investment results of an index composed of U.S ... What is the duration of a zero coupon bond? - Quora Mar 12, 2015 — Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount ...12 answers · 16 votes: The duration of a zero coupon bond is the number of years to maturityWhat is the duration of a zero-coupon bond that has ...5 answersNov 16, 2017Are there bonds with zero duration? - Quora2 answersJan 30, 2018More results from Finance Archive | May 25, 2022 | Chegg.com What is the duration of a bond (it is also called Macaulay duration) that has a par value of $1,000, a coupon rate of 10.89 percent (paid annually), and that matures in 10 years? ... Your client is thinking of issuing a three year zero coupon bond which would be rated as AA. Such a bond does not currently exist in th. 1 answer Understanding Duration | BlackRock

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 9.770% yield. 10 Years vs 2 Years bond spread is 409 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.386% yield. 10 Years vs 2 Years bond spread is 106.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022). The India credit rating is BBB-, according to Standard & Poor's agency. Treasury Bonds: A Good Investment for Retirement? - Investopedia Treasury bonds (T-bonds) are government debt securities that are issued by the U.S. Federal government and sold by the U.S. Treasury Department. T-bonds pay a fixed rate of interest to investors... List of Mutual Funds with Zero Exit Load - Groww Liquid funds is the most popular category as debt funds with zero exit load.Here's a list of liquid funds with least exit load: Aditya Birla Sun Life Liquid Fund; The exit load for this fund is 0.0070% if redeemed within 1 day, 0.0065% if redeemed within 2 days, 0.0060% if redeemed within 3 days, 0.0055% if redeemed within 4 days, 0.0050% if redeemed within 5 days, 0.0045% if redeemed within ...

How Does Inflation Affect Fixed-Income Investments? Examples include corporate bonds, government debt, municipal bonds, and certificates of deposit. For instance, a company issues a 5% corporate bond with a $1,000 face value that matures in five ...

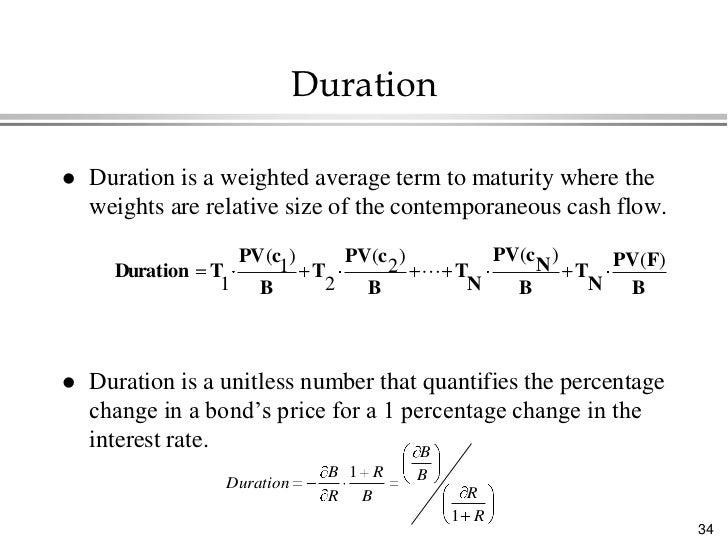

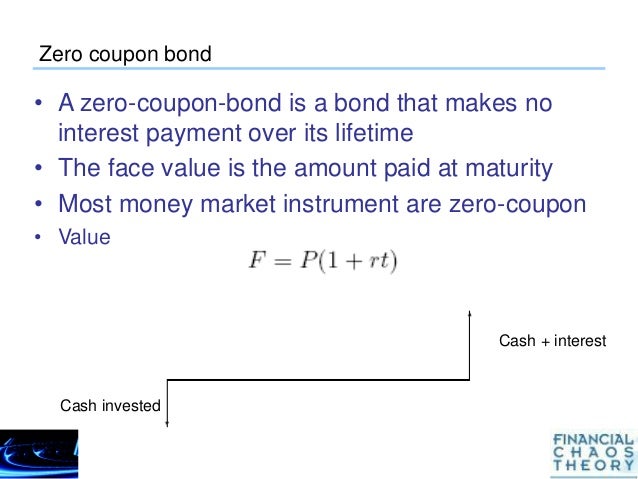

4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ...7 pages

PPT - Chapter 12 Bond Prices and the Importance of Duration PowerPoint Presentation - ID:1250230

Vanguard Extended Duration Treasury ETF Forecast The Vanguard Extended Duration Treasury ETF price gained 0.82% on the last trading day (Wednesday, 25th May 2022), rising from $104.53 to $105.39. , and has now gained 3 days in a row. It will be exciting to see whether it manages to continue gaining or take a minor break for the next few days.

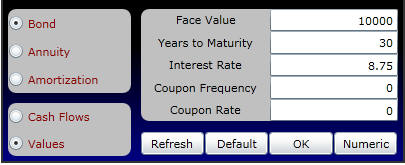

Why Are Bonds Down? - forbes.com The table shows the initial price of a ten-year $1,000 zero coupon bond for several different interest rates. For example, lending $905 to receive $1,000 in 10 years yields 1%. If rates are higher,...

ZROZ - Summary of PIMCO 25+ Year Zero Coupon U.S. Treasury Index ... View PIMCO 25+ Year Zero Coupon U.S. Treasury Index Exchange-Traded Fund (ZROZ) investment & fund information. Learn more about ZROZ on Zacks.com

Bonds You Can Build On | PIMCO Their durations (a measure of interest-rate sensitivity) typically range between 75% and 125% of the three-year average of the effective duration of the Morningstar Core Bond Index. A word about risk: All investments contain risk and may lose value.

Vanguard Extended Duration Treasury Index Fund Institutional Shares ... The investment seeks to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index of extended-duration zero-coupon U.S. Treasury securities. The advisor employs an indexing investment appro. ach designed to track the performance of the Bloomberg U.S. Treasury STRIPS 20-30 Year Equal Par Bond Index.

Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022. AAA RATED MUNI BONDS AA RATED MUNI BONDS

Abhishek Kothari 🇮🇳 on Twitter: "Muthoot Finance plans to raise at ... "Muthoot Finance plans to raise at least Rs75 cr via public issue of bonds Andhra Pradesh State Beverages Corp may raise funds via longer duration bonds next month CPs EXIM Bank to raise funds via three-month CP at 5.10% coupon Tata Power to raise funds via three-month CP at"

Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.17 pages

Tax Free Bond - REC Limited Foreign Currency Bonds. Post-issuance certification from Climate Bond Initiative, London; REC Green Bond Framework; Certificate from Climate Bond Initiative, London; Annual Update Report for Green Bonds as on March 31, 2021; Tax Free Bond; Infrastructure Bonds; Taxable Bond; Forms for Bonds; Market Linked Debentures

Post a Comment for "41 duration zero coupon bond"