42 perpetual zero coupon bond

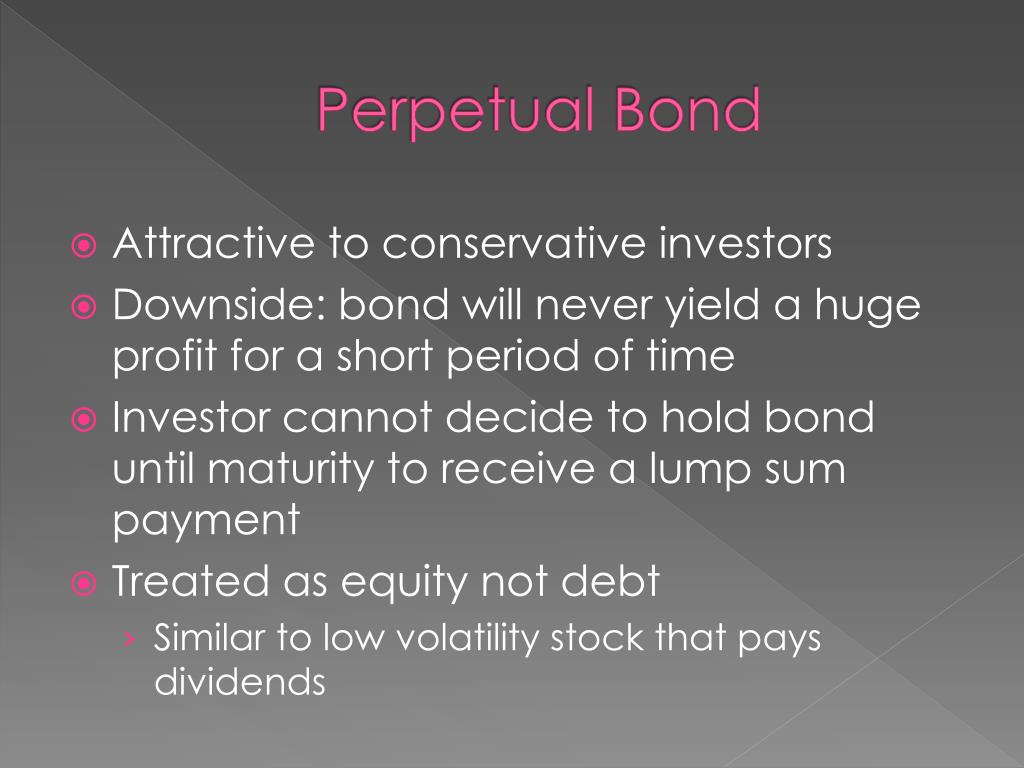

en.wikipedia.org › wiki › Current_yieldCurrent yield - Wikipedia Example. The current yield of a bond with a face value (F) of $100 and a coupon rate (r) of 5.00% that is selling at $95.00 (clean; not including accrued interest) (P) is calculated as follows. › terms › pPerpetual Bond Definition Mar 19, 2020 · The discount rate denominator reduces the real value of the nominally fixed coupon amounts over time, eventually making this value equal zero. As such, perpetual bonds, even though they pay ...

en.wikipedia.org › wiki › Warrant_(finance)Warrant (finance) - Wikipedia Inflation-indexed bond; Perpetual bond; Zero-coupon bond; ... Warrants are issued in this way as a "sweetener" to make the bond issue more attractive and to reduce ...

Perpetual zero coupon bond

studyfinance.com › yield-to-maturityYield to Maturity | Formula, Examples, Conclusion, Calculator Apr 12, 2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding. finra-markets.morningstar.com › BondCenter › DefaultBonds Home - Morningstar, Inc. May 03, 2022 · Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ... study.com › learn › bonds-in-finance-questions-andBonds in Finance Questions and Answers | Study.com Consider a 9.00 percent coupon bond with six years to maturity and a current price of $958.50. Suppose the yield on the bond suddenly increases by 2 percent. 1.

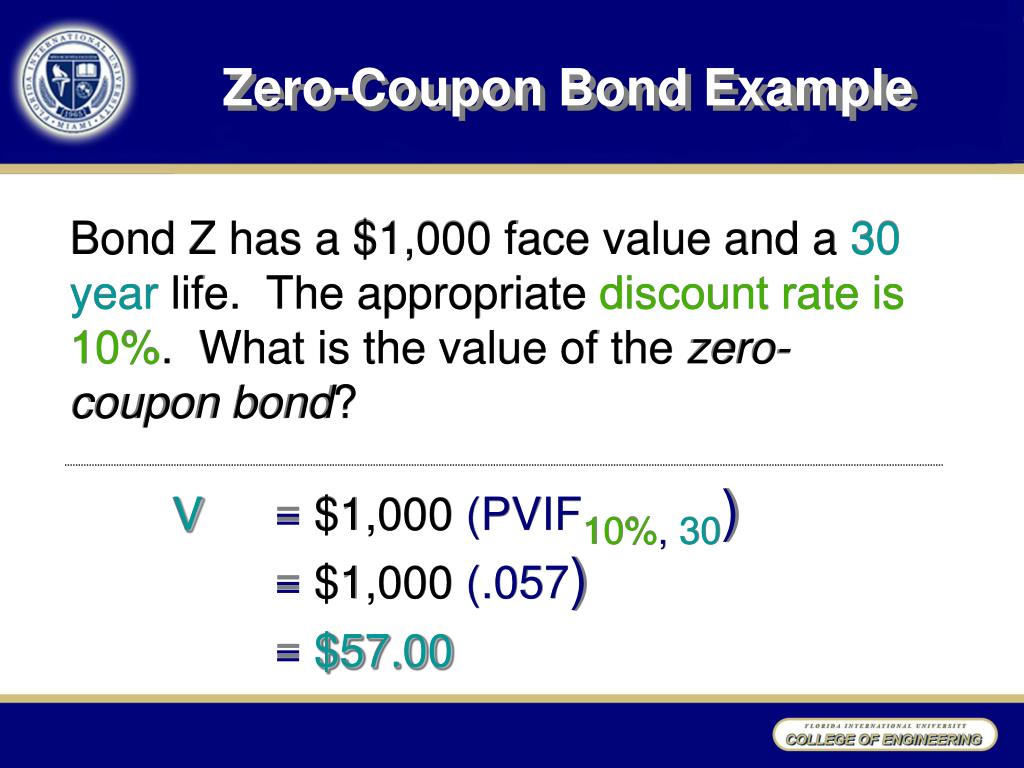

Perpetual zero coupon bond. efinancemanagement.com › sources-of-finance › bondsAll the 21 Types of Bonds | General Features and Valuation | eFM Apr 28, 2022 · It is also known as a straight bond or a bullet bond. Zero-Coupon Bonds. A zero-coupon bond is a type of bond with no coupon payments. It is not that there is no yield; the zero-coupon bonds are issued at a price lower than the face value (say 950$) and then pay the face value on maturity ($1000). The difference will be the yield for the investor. study.com › learn › bonds-in-finance-questions-andBonds in Finance Questions and Answers | Study.com Consider a 9.00 percent coupon bond with six years to maturity and a current price of $958.50. Suppose the yield on the bond suddenly increases by 2 percent. 1. finra-markets.morningstar.com › BondCenter › DefaultBonds Home - Morningstar, Inc. May 03, 2022 · Welcome to the Bond Section of the Market Data Center. This section includes general bond market information such as news, benchmark yields, and corporate bond market activity and performance information, descriptive data on U.S. Treasury, Agency, Corporate and Municipal Bonds, Credit Rating Information from major rating agencies, and price information with real-time transaction prices for ... studyfinance.com › yield-to-maturityYield to Maturity | Formula, Examples, Conclusion, Calculator Apr 12, 2022 · Yield to maturity (YTM) is the total expected return from a bond when it is held until maturity – including all interest, coupon payments, and premium or discount adjustments. The YTM formula is used to calculate the bond’s yield in terms of its current market price and looks at the effective yield of a bond based on compounding.

:brightness(10):contrast(5):no_upscale()/97615498-56a6941c3df78cf7728f1cd4.jpg)

Post a Comment for "42 perpetual zero coupon bond"