41 yield to maturity coupon bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Yield to Maturity Calculator | Good Calculators You can use this Bond Yield to Maturity Calculator to calculate the bond yield to maturity based on the current bond price, the face value of the bond, the number of years to maturity, and the coupon rate. It also calculates the current yield of a bond. Fill in the form below and click the "Calculate" button to see the results.

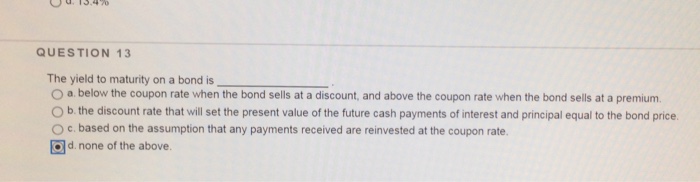

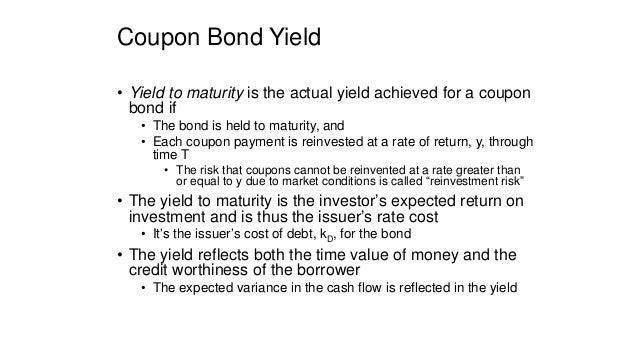

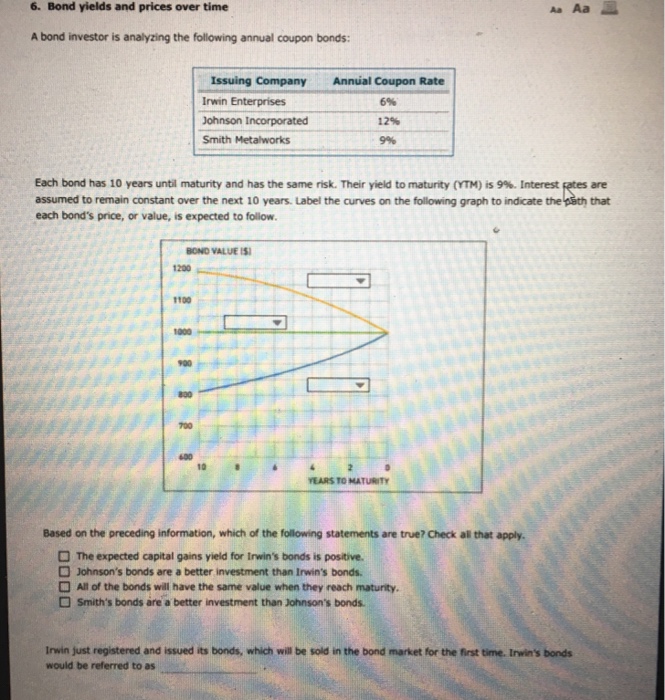

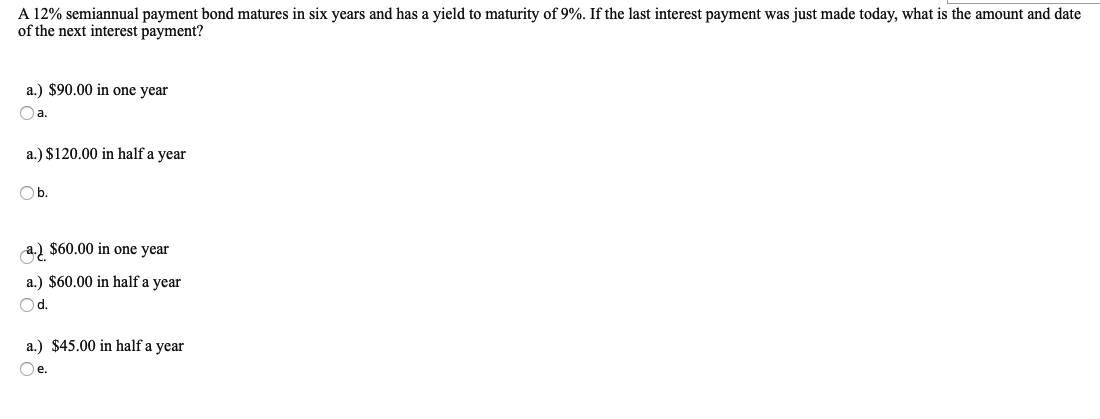

Solved Question 1 of 71 The yield to maturity on a coupon - Chegg Finance. Finance questions and answers. Question 1 of 71 The yield to maturity on a coupon bond is … · always greater than the coupon rate. · the rate an investor earns if she holds the bond to the maturity date, assuming she can reinvest all coupons at the current yield. · the rate an investor earns if she holds the bond to the maturity ...

Yield to maturity coupon bond

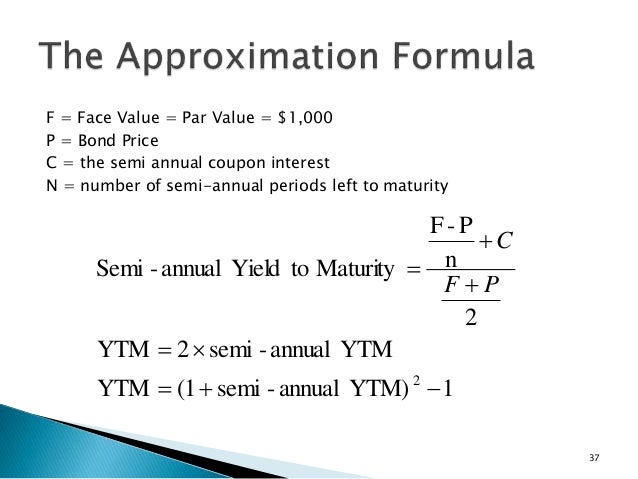

Yield to Maturity (YTM) - Definition, Formula, Calculations We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market. Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Show more Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value(the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

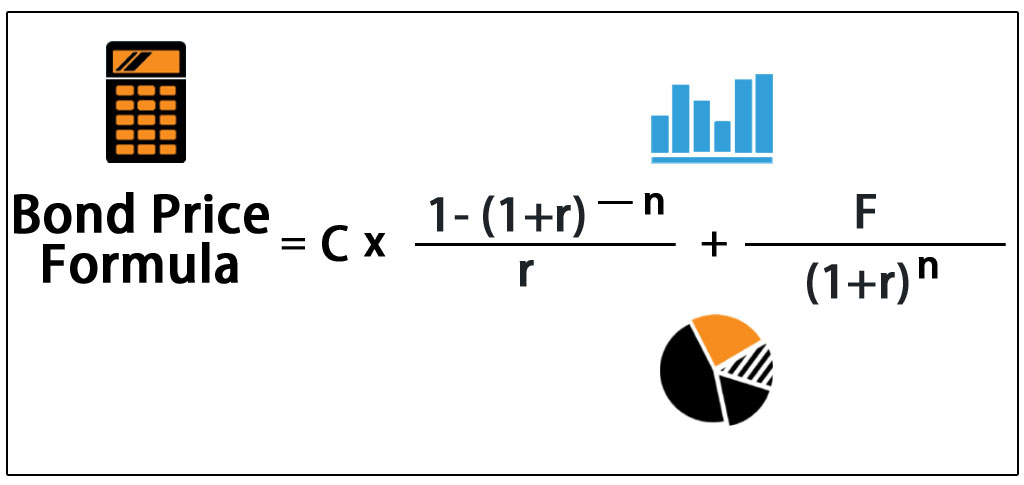

Yield to maturity coupon bond. Yield to Maturity | Formula, Examples, Conclusion, Calculator The approximate yield to maturity of this bond is 11.25%, which is above the annual coupon rate of 10% by 1.25%. You can then use this value as the rate (r) in the following formula: C = future cash flows/coupon payments r = discount rate (the yield to maturity) F = Face value of the bond n = number of coupon payments How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates etc, Please provide us with an ... Solved 5. The yield to maturity on a bond is - Chegg Question: 5. The yield to maturity on a bond is ________. A. below the coupon rate when the bond sells at a discount, and equal to the coupon rate when the bond sells at a premium. B. the discount rate that will set the present value of the payments equal to the bond price. C. based on the assumption that any payments received are reinvested at ... Yield to Maturity Calculator | Calculate YTM Determine the annual coupon rate and the coupon frequency; coupon rate is the annual interest you will receive by investing in the bond, and frequency is the number of times you will receive it in a year. In the yield to maturity calculator, you can choose from six different frequencies, from annually to daily. In our example, Bond A has a ...

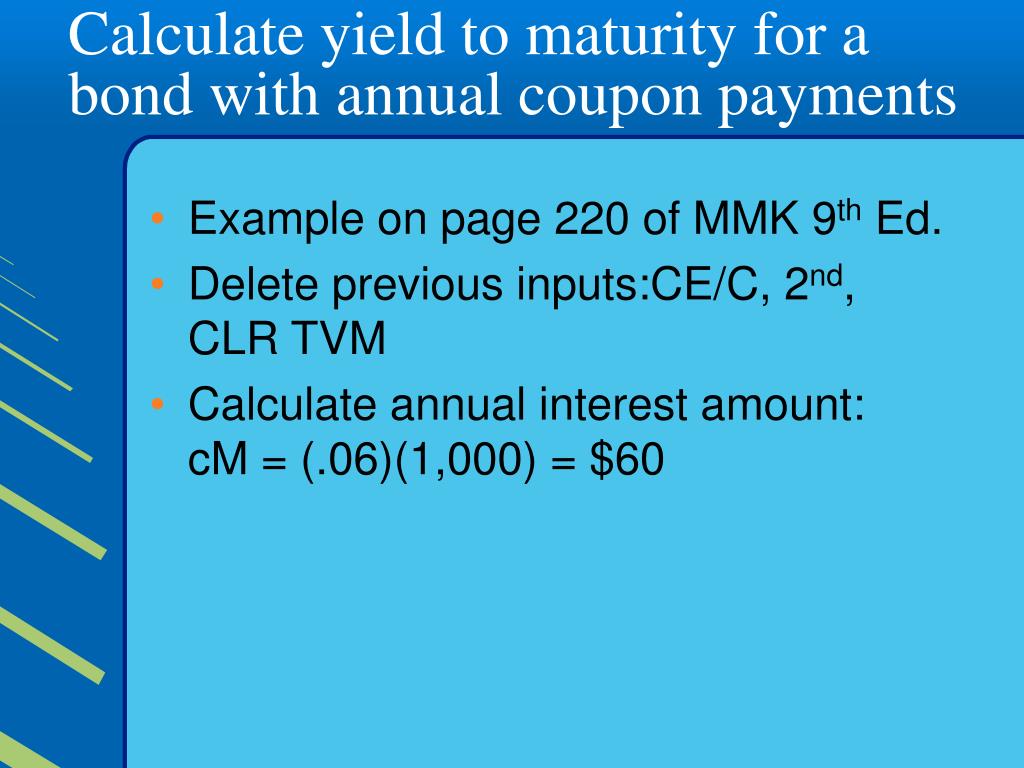

Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity Understanding Coupon Rate and Yield to Maturity of Bonds From 2.375%, quoted yield increased to 2.700%. Let's see how much you'd have to pay for the same security you bought a month ago: Notice that the bond is now worth 992,494.26, cheaper compared to a month ago. That's how much you'll buy the bond with a Php 1,000,000 Face Value. FIN 502 Mod 4 Yield to Maturity of a Coupon Bond.pptx Yield of a Coupon (Paying) Bond In practice, we observe the prices that the market is willing to pay for a bond But, often, we are more interested in the yields (YTM's) implied by those prices Most bond market quotes are in terms of yields, not prices So, given the observed market price (present value, or PV) of the bond and its promised future cash payments (annuity of coupon payments ... Yield to Maturity (YTM) - Meaning, Formula & Calculation Using the YTM formula, the required yield to maturity can be determined. 700 = 40/ (1+YTM)^1 + 40/ (1+YTM)^2 + 1000/ (1+YTM)^2 The Yield to Maturity (YTM) of the bond is 24.781% After one year, the YTM of the bond is 24.781% instead of 5.865%. Hence changing market conditions like inflation, interest rate changes, downgrades etc affect the YTM.

How to Calculate Yield to Maturity: 9 Steps (with Pictures) F = the face value, or the full value of the bond. P = the price the investor paid for the bond. n = the number of years to maturity. 2. Calculate the approximate yield to maturity. Suppose you purchased a $1,000 for $920. The interest is 10 percent, and it will mature in 10 years. The coupon payment is $100 ( ). Yield to Maturity (YTM): Formula and Excel Calculator The yield to maturity (YTM), as mentioned earlier, is the annualized return on a debt instrument based on the total payments received from the date of initial purchase until the maturation date. In comparison, the current yield on a bond is the annual coupon income divided by the current price of the bond security. Bond Yield to Maturity (YTM) Calculator - DQYDJ What's the Exact Yield to Maturity Formula? If you've already tested the calculator, you know the actual yield to maturity on our bond is 11.359%. How did we find that answer? We calculated the rate an investor would earn reinvesting every coupon payment at the current rate, then determining the present value of those cash flows. Yield to maturity - Wikipedia Formula for yield to maturity for zero-coupon bonds = ... Suppose that over the first 10 years of the holding period, interest rates decline, and the yield-to-maturity on the bond falls to 7%. With 20 years remaining to maturity, the price of the bond will be 100/1.07 20, or $25.84. Even though the yield-to-maturity for the remaining life of ...

Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ...

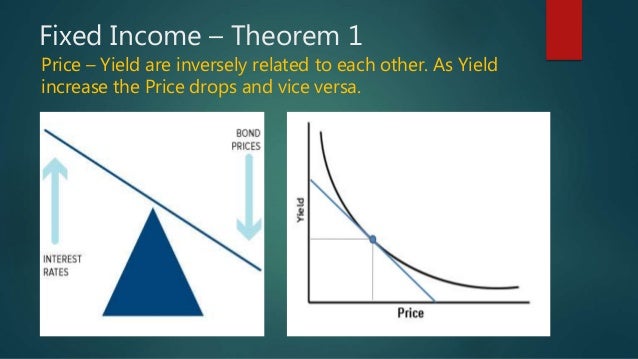

Current Yield vs. Yield to Maturity: What's the Difference? Yield to maturity is a way to compare bonds with different market prices, coupon rates, and maturities. Formula The current yield of a bond is easily calculated by dividing the coupon payment by the price. For example, a bond with a market price of $7,000 that pays $70 per year would have a current yield of 7%. 3

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest...

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Basics Of Bonds - Maturity, Coupons And Yield Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of...

Python Yield Curve Bond Yield curve rates between 1990 and present are from the U (2) Assuming the yield curves yield rates are effective rates, for example, for a yield curve with points (1,4%) and (2,5%) where its (x,y)=(maturity,yield) does this suggest that, one could currently invest in a zero coupon bond and receive a 4% return at the end of the year, and that ...

By yield to maturity? Explained by FAQ Blog How does yield to maturity affect duration? Duration is inversely related to the bond's coupon rate. Duration is inversely related to the bond's yield to maturity (YTM). Duration can increase or decrease given an increase in the time to maturity (but it usually increases). You can look at this relationship in the upcoming interactive 3D app.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value(the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Calculate the YTM of a Coupon Bond - YouTube This video explains the meaning of the yield to maturity (YTM) of a coupon bond in the coupon bond valuation formula and how to calculate the YTM using a financial calculator. Show more

Yield to Maturity (YTM) - Definition, Formula, Calculations We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands that are trading in the US market.

Post a Comment for "41 yield to maturity coupon bond"