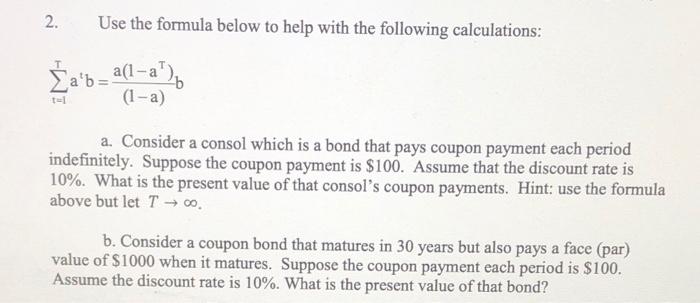

42 present value formula coupon bond

Coupon Rate Calculator | Bond Coupon 15.07.2022 · As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total …

› zero-coupon-bondZero Coupon Bond - (Definition, Formula, Examples, Calculations) = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest Compound Interest Compound interest is the interest charged on the sum of the principal amount and the total interest amassed on it so far.

Present value formula coupon bond

What Is Present Value (PV)? - Investopedia 13.06.2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ... › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Net present value - Wikipedia Formula. Each cash inflow/outflow is discounted back to its present value (PV). Then all are summed such that NPV is the sum of all terms: (+)where is the time of the cash flow is the discount rate, i.e. the return that could be earned per unit of time on an investment with similar risk is the net cash flow i.e. cash inflow – cash outflow, at time t.

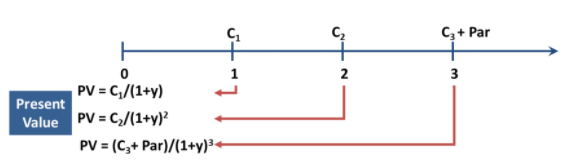

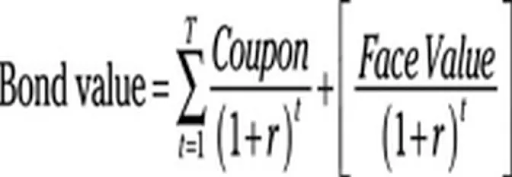

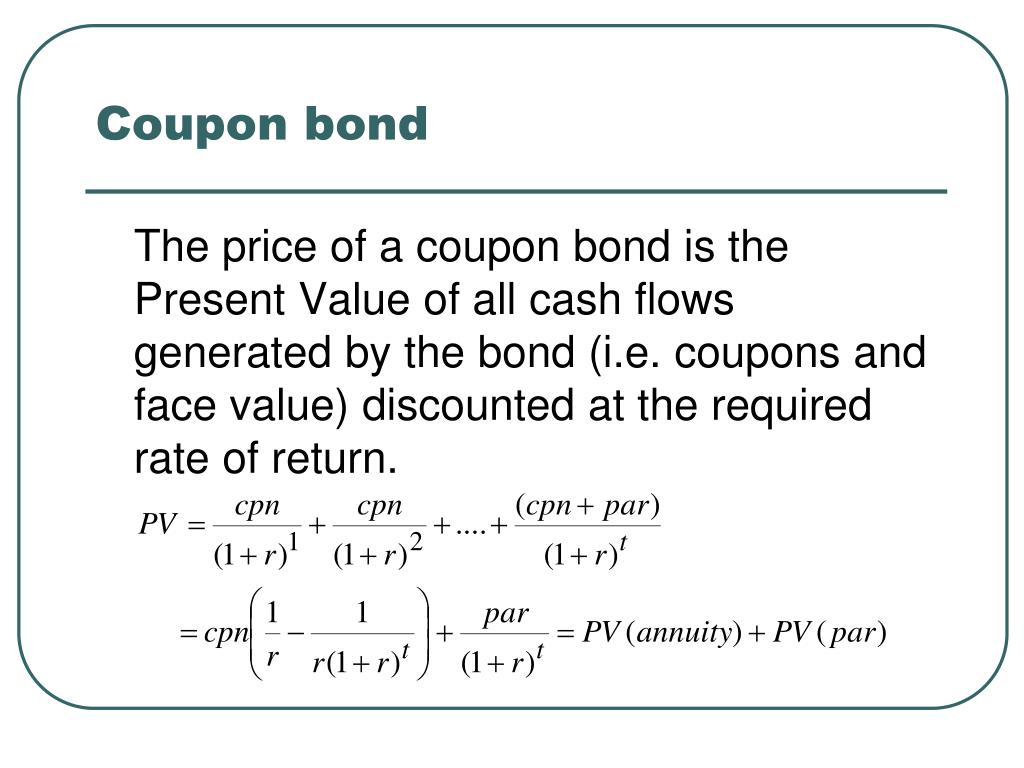

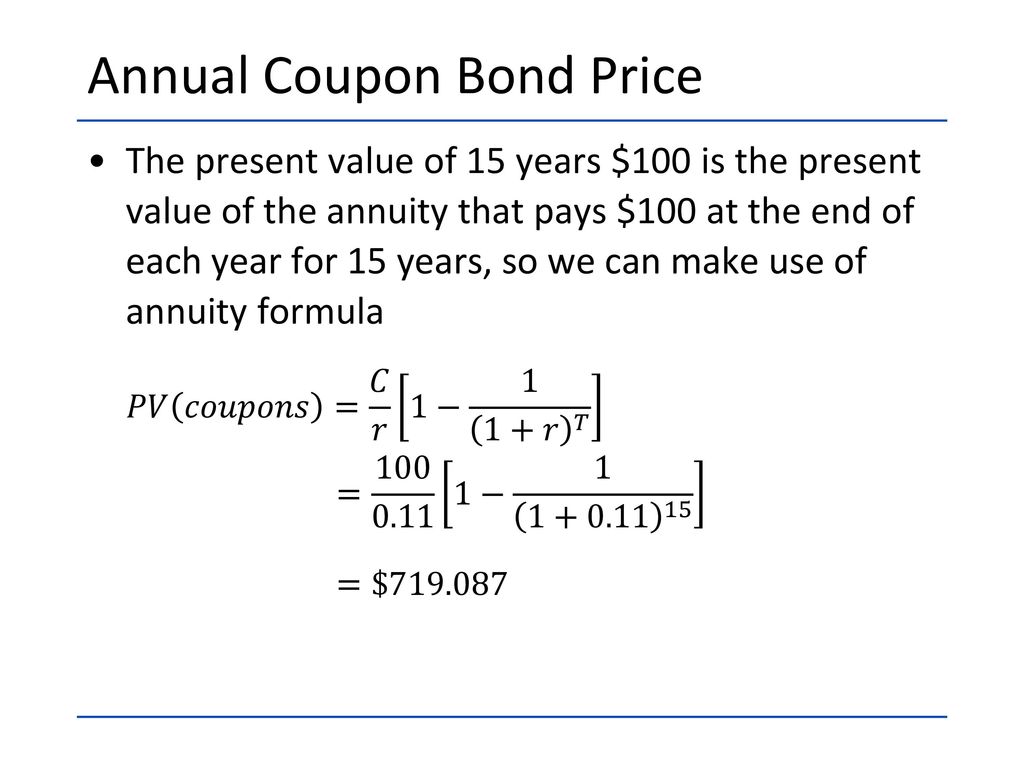

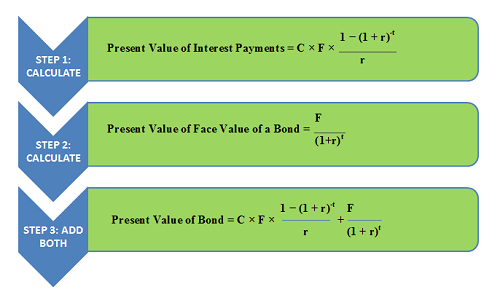

Present value formula coupon bond. Bond Formula | How to Calculate a Bond | Examples with Excel … Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%. Bond Pricing Formula | How to Calculate Bond Price? | Examples Formula to Calculate Bond Price. The formula for bond pricing Bond Pricing The bond pricing formula calculates the present value of the probable future cash flows, which include coupon payments and the par value, which is the redemption amount at maturity. The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is the … Bond Price Calculator | Formula | Chart 20.06.2022 · Bond price is calculated as the present value of the cash flow generated by the bond, namely the coupon payment throughout the life of the bond and the principal payment, or the balloon payment, at the end of the bond's life.You can see how it changes over time in the bond price chart in our calculator. To use bond price equation, you need to input the following … › bond-pricing-formulaBond Pricing Formula | How to Calculate Bond Price? | Examples where C = Periodic coupon payment, F = Face / Par value of bond, r = Yield to maturity (YTM) and; n = No. of periods till maturity; On the other, the bond valuation formula for deep discount bonds or zero-coupon bonds Zero-coupon Bonds In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a discount to ...

Bond Present Value Calculator See Present Value Concepts - Calculating the Present Value of a Bond and Present Value of a Bond Formula for discussions on computing the present value of bonds. Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Yield to Maturity Calculator Zero Coupon ... Calculating Present and Future Value of Annuities - Investopedia 25.04.2022 · For example, you could use this formula to calculate the present value of your future rent payments as specified in your lease. Let's say you pay $1,000 a month in rent. Below, we can see what the ... Net present value - Wikipedia Formula. Each cash inflow/outflow is discounted back to its present value (PV). Then all are summed such that NPV is the sum of all terms: (+)where is the time of the cash flow is the discount rate, i.e. the return that could be earned per unit of time on an investment with similar risk is the net cash flow i.e. cash inflow – cash outflow, at time t. › bond-formulaBond Formula | How to Calculate a Bond | Examples with Excel ... Bond Formula – Example #2. Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each coupon bond issued by SDF Inc. if the YTM based on current market trends is 4%.

What Is Present Value (PV)? - Investopedia 13.06.2022 · Present Value - PV: Present value (PV) is the current worth of a future sum of money or stream of cash flows given a specified rate of return . Future cash flows are discounted at the discount ...

Post a Comment for "42 present value formula coupon bond"